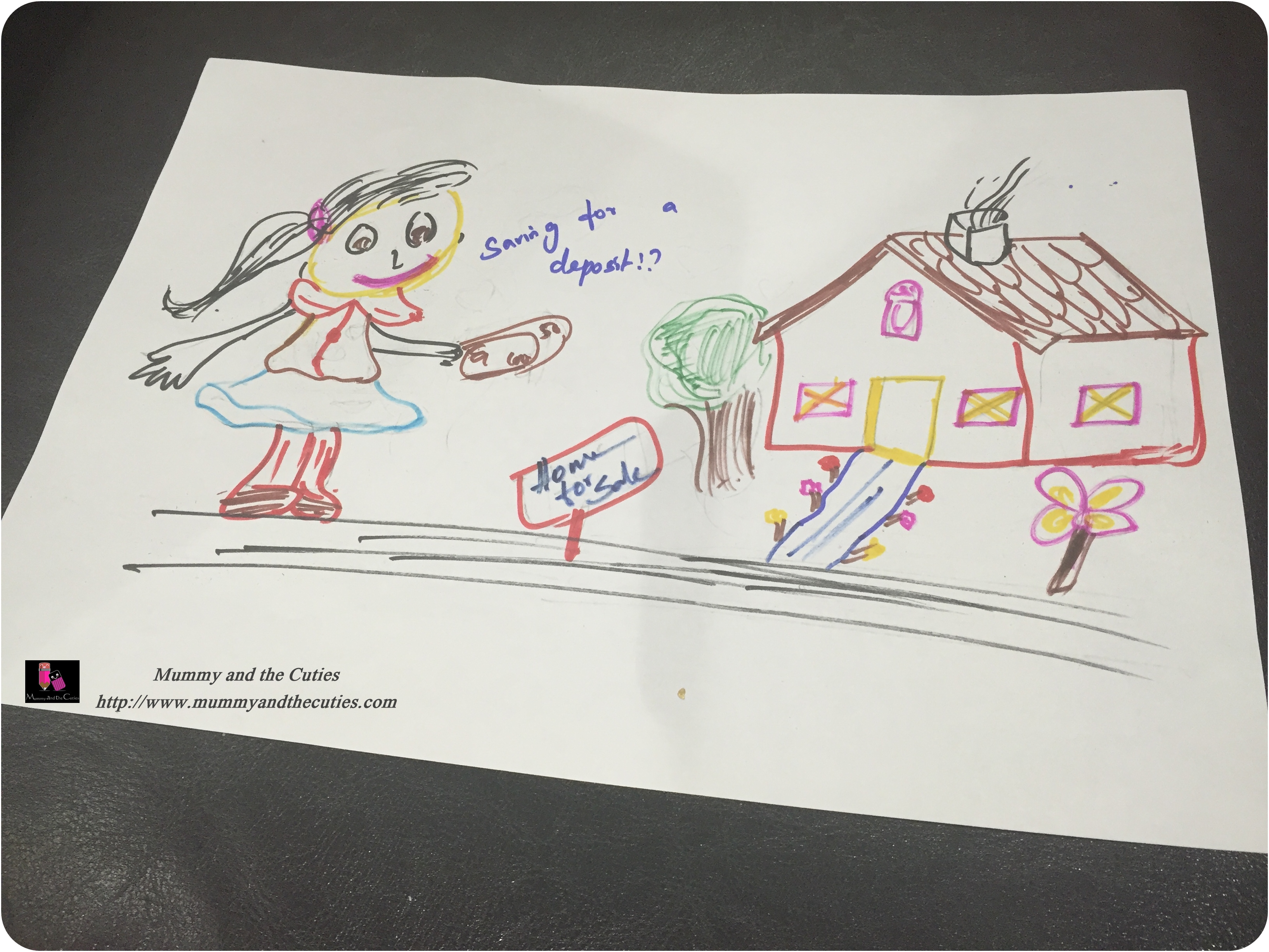

Owning a house is a dream of many and of course it was one for my parents too. As they had to put their dream aside and spend everything they earned on my studies, the first best thing I did for them is buying a house! It may look a bit weird for a few, it is not actually and as far it is home that makes everyone happy, It is acceptable. I am still proud of what I did.

Buying a home needs a lot of planning, budgeting and dedication (and may be a lot of scarification while doing the cost cutting). Saving for a deposit on a new home can be an agonisingly slow process. It takes a good time to build up such a large sum of money without compromising on life’s essentials, or without sacrificing all of the luxuries and leisure activities you are used to.

However, with determination, proper plan and effort, you can save up all you need to secure that dream home – without having to survive on soup or giving up your social life completely.

Here are some tips to consider while you are planning to buy your new home and to save money for the deposit.

Decide where to buy

Instead of buying in a city, considering the outskirts and country side will save a you a lot of money, but it purely depends on your work location and your preference of where you want to live. You may also have to consider the resale value, property price appreciation etc. It may also depend on whether you are buying for you to live or to rent it out.

Consider Shared ownership properties

There are a lot of new builds now and most of them offer shared ownership. Research about how this scheme works and find out if it is something you could consider. It is very helpful when you don’t have a lot of money for the deposit but can save over time and buy in increments.

If you live in one of the major cities like Manchester, the developers like Laurus homes have a lot of new builds in Greater Manchester at an affordable price and with a lot of options to suit everyone’s need. My friend has just got her flat on shared ownership and living happily in her own flat. They have a lot of customer stories here which might come in handy.

Make a budget

Sitting down with your bank statements and drawing up a budget is only the first step. You need to allocate funds to each type of expense and work out everything down to the last penny. To make sure you stick to it, make a list for every purchase, especially when it comes to supermarket food shopping.

Compare prices and switch suppliers

Are you absolutely sure you’re getting the cheapest deal on everything, including your phone, broadband and utilities? By shopping around and switching to a better deal, you could save a decent amount to put towards your deposit.

Make use of the right financial products

Depending on your circumstances, there are savings accounts and other banking products that could help boost your savings total. If you’re a first-time buyer for example, you can use Help to Buy ISAs to get a boost of up to £3,000. If you already have a property and are having trouble selling it, a quick and easy way of getting the funds for your deposit is to use a service like We Buy Any House, which won’t give you market value but is a fast way to get you more than enough for your deposit.

Sacrifice non-essentials, but leave yourself with some treats

If you can quit smoking, cut down on drinking and stop luxuries such as Netflix and magazine subscriptions, you’ll save a significant chunk of cash each month. Going further, you can skip the foreign holiday in favour of a couple of much cheaper UK weekends away. Don’t cut out absolutely everything though, as it’ll make your life a misery and much harder to stick to your budget.

Give up your car

If you can manage on public transport, or perhaps on foot or on a bicycle, you could save a lot of money by giving up your car for a while. Even if you keep the car but declare it off the road, the money you’ll save on insurance, road tax, fuel and maintenance could go a long way towards helping with your deposit.

Ask for help

If your parents are able and willing to help you out with your deposit, don’t be ashamed to accept their help. Owing money to a family member isn’t ideal, but it’s also a lot cheaper than a loan and it could get you into your new home sooner, meaning less spent on rent. Plus, if you can stump up a bigger deposit, it could get you a cheaper mortgage deal.

Consider moving home for a while

If you have the option, moving home or in with a friend for even a few months could help you reach your deposit goal faster. You will no longer have to pay rent and your bills will (hopefully) be cheaper if you’re sharing them with your family. It’s not ideal, but remember that it’s not forever.

Rather than cutting down your essential needs, it is wiser to make reasonable choices that would save money.

Do you have a dream house in mind!? Have you got any budgeting plans that really worked out well? We would love to hear your tips to save money.

Have you done any budgeting in the past!? if you have any more tips, I would love to hear.

e-meet you in the next post… Take care…

Bye,

~ Rishi ~