Regardless of how well we do and how smart we manage our finance, most of us would hit a situation to manage a financial shortage/crisis. A poorly managed financial shortage would lead to a lot of stress and depression and affect both the physical and mental health in the worst possible way. But it doesn’t have to end up in that way, there are many options to explore which can get out of the situation as quickly as possible.

Ask friends and family

It is best to explain the situation to friends and family and see if they could help. You don’t have to get it all from just one person, but take any offer even if it is very little. The one most important thing I insist here would be, be open to them about when you can pay them back and keep up the commitment and don’t break the trust. In that way, they will always be willing to help.

Sell the unwanted things and make cash

Unknowingly or knowingly, we all get into the habit of buying things that we won’t or hardly use. If you start decluttering the house, you will end up in many things you have never seen or even think about it over months or even years. Sites like eBay and gumtree are very productive places to sell such items and make cash.

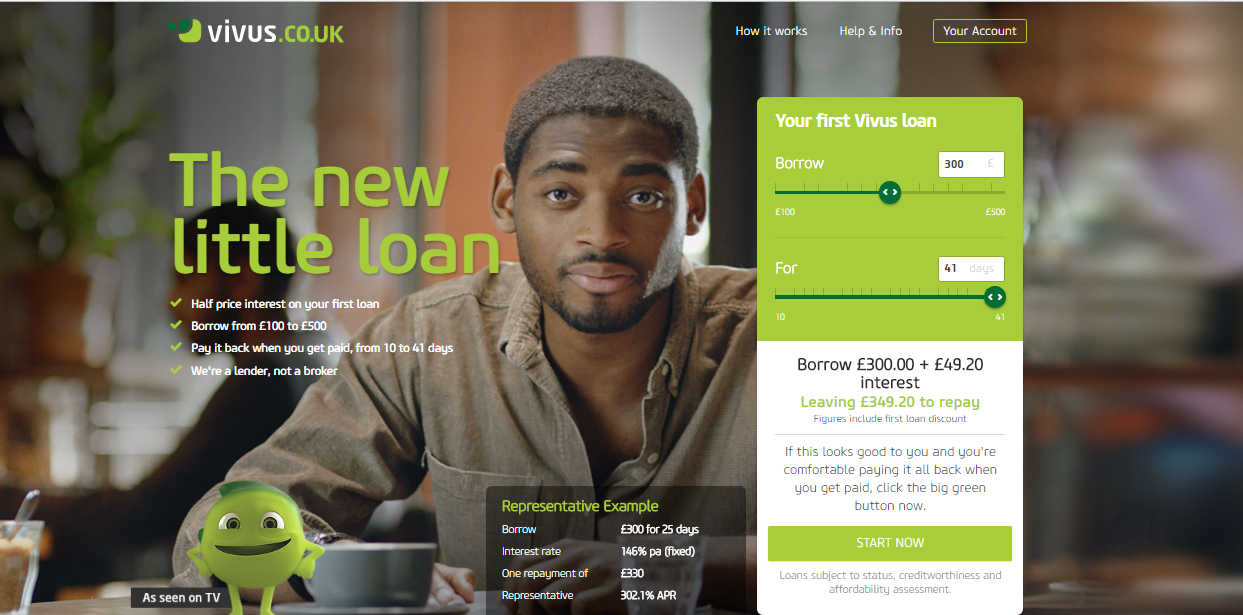

Look for a short term loan

Although it seems impossible to secure a loan when you are in crisis, lenders such as Cashlady can offer you a short term loan based on your credit score and fund performance in the past. They are not the lenders but are the brokers, so when you apply with them, your application will be presented to many trusted, well established lenders, thereby increasing your chances of being accepted. But before applying, make yourself aware of the terms and conditions.

Learn your expenses and explore the ways to minimise it

Prepare an expense sheet and find out where the money actually goes every month. Explore the options to reduce the expenses and look for cheaper replacements if you could. For example, you can think about sharing the flat with your friend if you have one you can rely on. Utilities are usually the expenses that goes beyond budget unknowingly. Be Eco-friendly and cut down the amount of electricity, gas and water usage.

Apply for interest free credit cards

If your credit score is good, you may be eligible for some Interest free credit cards that you can use for the purchases but can start paying back after few months. This is one of the very good options to consider not only during financial shortage but even when you plan to renovate your home. Sites like Moneysupermarket and Topcashback have a very good comparison feature that will help you find the best credit card.

Have you been in a situation to manage your finance in tough situation…? How have you handled it? Any tips, I would love to hear….

Take care….

Rishi