Whether you are rich or poor, at some point in life, most of us may have to manage a sudden surge in financial emergency and would be looking for options to keep moving. It could be buying your first home and securing a little more amount for deposit, or being made redundant while you are repaying the mortgage, buying a car and making it as a good deal by paying the full amount upright or even a sudden medical expense!?

Why it is often difficult to secure a short term loan?

Although there are many financial providers, not all of them are easy to approach and it is hard to find a someone where you can secure a short term loan. Most of the financial providers prefer their customers to bind to a long term loan and often try to convince to borrow more even if you are just looking for some cushion until your next pay cheque.

As not all the banks and building societies offer short term loans, the choice of providers are much less in numbers that declares high interest rate for short term loans.

Most times you would be asked to supply a guarantee and need to put down an asset such as your house or car as collateral.

Things you should consider while looking for a short term loan

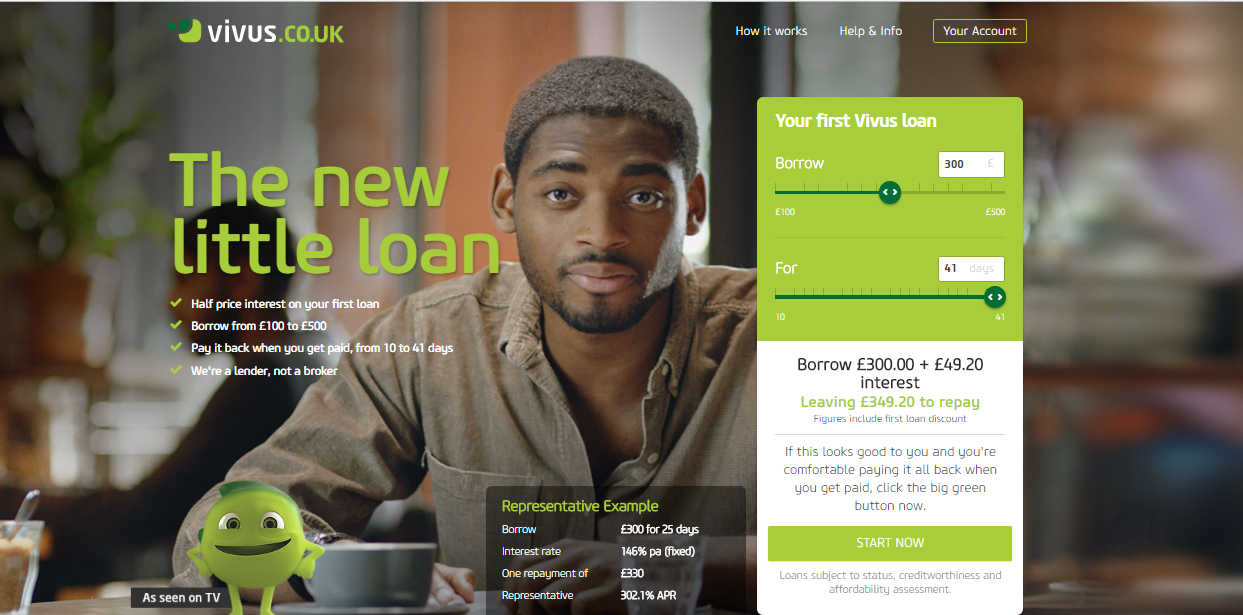

Interest rates are usually high for short term loans, so though you need the cash urgently, do spend some on research looking for the best interest rates with lesser hassle. Sites like TopCashback and MoneySuperMarket are some good tools to compare the providers and they provide cashback too sometimes.

Don’t be afraid to ask questions about the hidden fees and any additional charges that you may incur during the term of the loan.

Short term loan usually means, securing a loan on the same day! So, look for providers who are quicker in releasing the cash to you.

Flexibility in repayment and charges and fees if you would like to do an early repayment or close the loan before the tenure.

Your credit score influences the possibilities of securing a loan. But don’t worry if you have a poor credit score, some providers have other options for customers with poor credit rating.

You need to be extra careful before choosing the provider. Be well aware of the terms and conditions and make sure everything is transparent. Some financial providers make it easier and transparent to the customers looking for a short term loan.

Decide if you really need a short term loan?

Often there are other options before looking for a short term loan!

- Interest Free Overdrafts from your bank – Most of the banks often provide an interest free overdraft for a short period of time (say a month) to privilege customers and there would be a small monthly fee you pay for this service! Explore the possibilities of becoming a privilege customer.

- Interest free credit cards – There are interest free credit cards for a certain period of time with a limit based on your income and other assets. If you are looking for a short term loan to buy something, why not consider this route?

- Can friends help? – You never know unless you ask. Do you have some close friends who can be of a help in tough situations!? When we bought our first home, we found it hard to secure a home loan for us as I was not working and hubby’s income was not up to the expectation. So ,We were in a situation to pay a higher deposit amount and got some help from friends. “Remember to pay back and keep the honesty to keep the friendship going long-term”

- And finally, It is not always for a negative cause, sometimes getting a short term loan and paying it on time would help to boost the credit score.

What to ask to the loan providers before signing the agreement

- Ask for the interest rate and other hidden fee.

- Enquire about early repayment charges.

- Check with the provider if they update to the Credit Bureau if you make the payments on time. – This might increase your credit score.

Did you find the tips useful? Have you ever looked for a short term loan or a pay day loan!? have you got any tips to make it hassle-free? I would love to know your thoughts.

Thanks for stopping by,

Until next post ….

Rishi